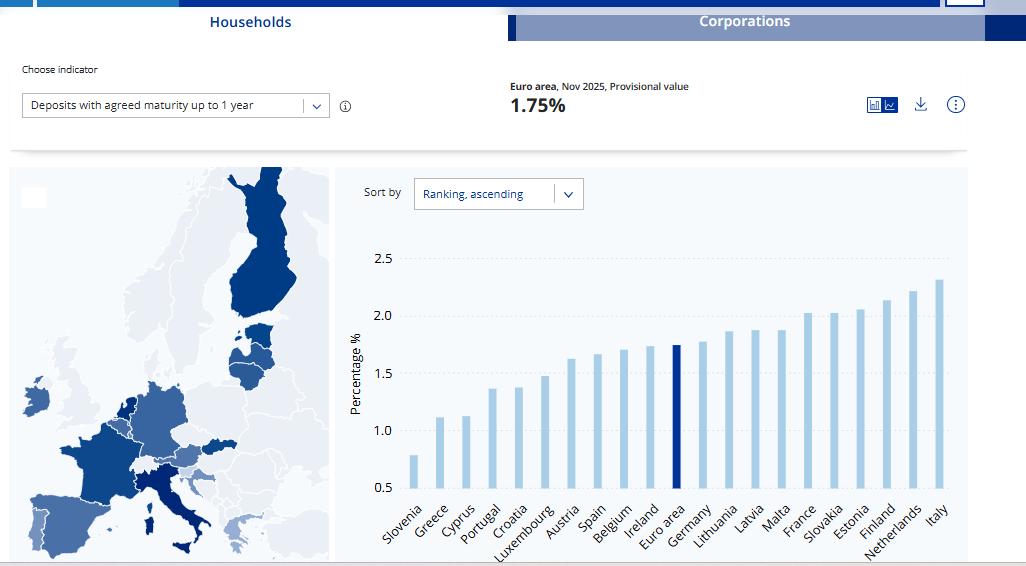

Interest rates on bank deposits in Cyprus showed moderate growth in November 2025, according to the latest data from the European Central Bank. At the same time, the country remains among the three eurozone states with the lowest deposit rates. For household deposits with a maturity of up to one year, the rate rose to 1.13%, compared with 1.07% in October and 1.10% in September. Despite the increase, Cyprus ranks third from the bottom, ahead of only Slovenia at 0.79% and Greece at 1.12%.

By comparison, the most attractive conditions for depositors continue to be offered by banks in Italy, where rates reach 2.32%. High levels are also recorded in the Netherlands at 2.22% and in Finland at 2.14%. The eurozone average in November stood at 1.75%, slightly down from 1.77% in October, highlighting how Cyprus’s deposit market continues to lag behind broader European trends.

Corporate Deposits: Lowest Rates in the Eurozone

The gap is even more pronounced for deposits by non-financial corporations. In Cyprus, the rate on corporate term deposits fell to 0.89%, down from 1.03% in October and 1.18% in September—the lowest level among all eurozone countries. At the same time, businesses in France earn deposit returns of around 2.13%, while in Estonia the figure is 2.04%. This disparity is fueling debate over the attractiveness of Cyprus’s banking system for corporate clients, particularly against the backdrop of persistently high liquidity across the EU.

Household Loans: Cyprus Below the Eurozone Average

Against the backdrop of weak deposit rates, Cyprus looks more appealing from a lending perspective. Interest rates on consumer loans stood at 6.2% in November, up slightly from 6.18% in October and 5.84% in September. This level is well below the eurozone average of 7.33%. The highest consumer lending rates were recorded in Estonia at 13.26%, Latvia at 12.29%, and Greece at 10.04%.

Mortgages Remain Relatively Affordable

Mortgage loans in Cyprus also remain cheaper than the eurozone average. The average rate on housing loans is around 3%, compared with a eurozone average of 3.3%. This continues to support interest in the property market, particularly amid price stabilization and the cautious easing of monetary policy by the ECB that analysts expect in 2026.

Businesses Under Pressure from High Borrowing Costs

Despite relatively affordable credit for households, Cypriot businesses continue to face high borrowing costs. According to ECB data, Cyprus has the fifth-highest business lending rates in the eurozone. This constrains investment activity, especially among small and medium-sized enterprises, and remains one of the key challenges for the country’s economy amid slowing growth across the EU.

Overall Picture: Stability Without a Breakthrough

Overall, Cyprus’s banking market shows stability, but without sharp improvements. Growth in deposit rates remains limited, while the country’s advantages are most evident in household lending. Experts note that future developments will depend directly on decisions by the European Central Bank and the broader inflation trajectory in the eurozone, which by the end of 2025 is showing signs of gradual cooling.